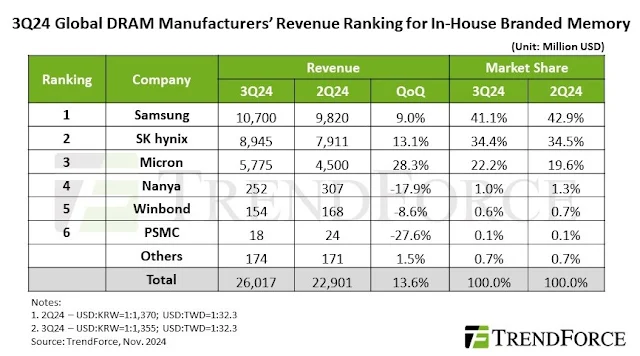

The global DRAM market experienced a 13.6% revenue increase in the third quarter of 2024, driven by strong demand for DDR5 and HBM memory, according to a report by TrendForce.

Despite a decline in shipments of older memory types like LPDDR4 and DDR4, the overall market revenue grew by $3.1 billion, reaching $26.02 billion, up from $22.9 billion in Q2 2024.

Market Share and Growth

Samsung maintained its leading position with a 41.1% market share, although this represents a slight decrease of 1.8% compared to the previous quarter. However, Samsung's revenue still grew by 9% QoQ.

SK Hynix and Micron also saw significant growth, with revenue increases of 13.1% and 28.3%, respectively. Micron's growth was particularly notable, attributed to increased shipments of server DRAM and HBM3e. Micron now holds a 22.2% market share, up from 19.6% in Q2.

In contrast, Taiwanese DRAM suppliers like Nanya, Winbond, and PSMC experienced revenue declines.

Market Trends and Future Outlook

Despite revenue growth, major players are reportedly trimming DRAM supply to focus on upgrading their equipment. Meanwhile, Chinese DRAM companies are increasing their shipments, potentially impacting contract prices for DRAM and HBM.

TrendForce forecasts further DRAM revenue growth in Q4 2024, with Chinese suppliers expected to play a significant role in driving this expansion.

Source: TrendForce