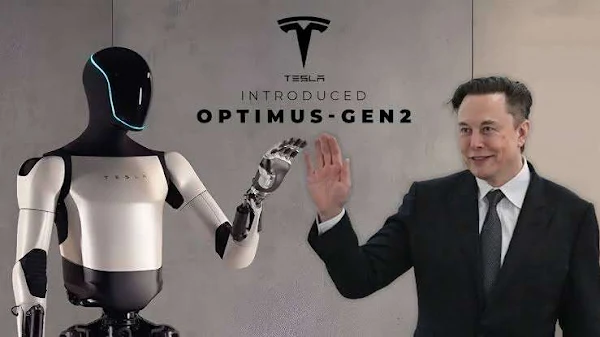

Bank of America (BofA) analyst John Murphy has increased Tesla's stock price target, highlighting the potential of the Optimus robot. While currently used for menial tasks in Tesla factories, Optimus's role is expected to expand significantly.

Murphy points out that Optimus currently utilizes a small percentage of Tesla's compute resources. However, as robotaxi technology matures, more resources will likely be allocated to Optimus development.

"Optimus accounts for only a single-digit percentage of TSLA’s compute, but we expect the resources available for Optimus will grow as the robotaxi technology matures."

Tesla aims to deploy around 1,000 Optimus robots in its factories by the end of 2025. This increased usage should, in turn, free up more compute resources, accelerating Optimus's capabilities and potentially leading to increased production and lower costs in 2026 and beyond.

JUST IN: TESLA $TSLA PRICE-TARGET RAISED TO $400 (FROM $350) AT BANK OF AMERICA -- ANALYST SAYS "OPTIMUS IS REAL AND DEVELOPMENT IS POISED TO ACCELERATE"

— Stock Talk (@stocktalkweekly) December 5, 2024

"Optimus is currently used by TSLA to sort 4680 cells with no intervention. TSLA is testing Optimus in various use cases… pic.twitter.com/qC6L15UJTg

While acknowledging the possibility of Tesla raising additional capital to fund Optimus development, Murphy has raised BofA's price target for Tesla from $350 to $400. This represents an 11% upside from the current stock price of $358.

Optimus uses an AI-powered brain trained by a neural network, allowing it to interact with its environment. The robot can currently perform basic tasks and has advanced AI capabilities in development, including object tracking and obstacle navigation. Despite its size, Optimus is equipped with sensitive tactile sensors, enabling it to handle delicate objects.

Deutsche Bank has projected that Optimus could generate $10 billion in annual revenue for Tesla by 2035, based on estimated sales of 200,000 units at an average selling price of $50,000.

This is not investment advice. The author has no position in any of the stocks mentioned.